Advanced AI Products,

Driven by Personalization

Personalization AI for

Marketing and

Sales

Personalization AI for Marketing and Sales

Personalization is the key to staying ahead in today’s competitive market

We help you connect with customers in meaningful ways. By combining tailored experiences with transparent AI, you can make smarter, faster decisions that build trust, drive engagement, and boost loyalty.

We help you connect with customers in meaningful ways. By combining tailored experiences with transparent AI, you can make smarter, faster decisions that build trust, drive engagement, and boost loyalty.

Personalization is the key to staying ahead in today’s competitive market

New Contacts (1,710)

+15% this week

This week

400

300

200

100

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

New Companies (290)

-3% this week

This week

80

60

40

20

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

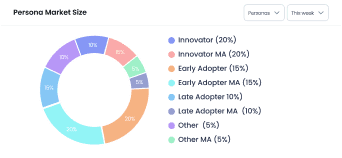

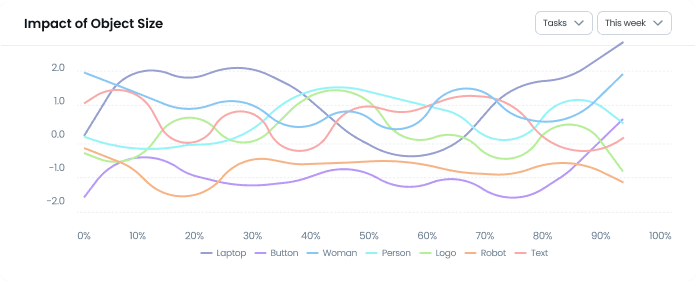

Overall Impact of Creative Elements

Creative Elements

10%

10%

10%

20%

15%

10%

15%

10%

Background (10%)

CTA Content (15%)

Logo Brand (10%)

Message (15%)

Tagline (20%)

Audience (10%)

Text Overlay (10%)

Font (10%)

New Contacts (1,710)

+15% this week

This week

400

300

200

100

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

New Companies (290)

-3% this week

This week

80

60

40

20

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

Overall Impact of Creative Elements

Creative Elements

10%

10%

10%

20%

15%

10%

15%

10%

Background (10%)

CTA Content (15%)

Logo Brand (10%)

Message (15%)

Tagline (20%)

Audience (10%)

Text Overlay (10%)

Font (10%)

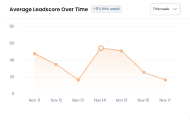

New Contacts (1,710)

+15% this week

This week

400

300

200

100

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

New Companies (290)

-3% this week

This week

80

60

40

20

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

Overall Impact of Creative Elements

Creative Elements

10%

10%

10%

20%

15%

10%

15%

10%

Background (10%)

CTA Content (15%)

Logo Brand (10%)

Message (15%)

Tagline (20%)

Audience (10%)

Text Overlay (10%)

Font (10%)

New Contacts (1,710)

+15% this week

This week

400

300

200

100

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

New Companies (290)

-3% this week

This week

80

60

40

20

0

Nov 11

Nov 12

Nov 13

Nov 14

Nov 15

Nov 16

Nov 17

Overall Impact of Creative Elements

Creative Elements

10%

10%

10%

20%

15%

10%

15%

10%

Background (10%)

CTA Content (15%)

Logo Brand (10%)

Message (15%)

Tagline (20%)

Audience (10%)

Text Overlay (10%)

Font (10%)